# 20_볼린저밴드_01

import FinanceDataReader as fdr

df = fdr.DataReader('005380', '2015')

df

df = df.loc[:, ['Close']].copy()

df

|

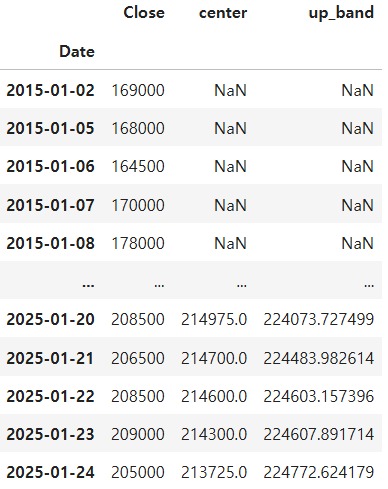

df['center'] = df['Close'].rolling(window=20).mean()

df |

df['up_band'] = df['center'] + 2*df['Close'].rolling(window=20).std()

df |

df['low_band'] = df['center'] - 2*df['Close'].rolling(window=20).std()

df

|

df = df.dropna()

df |

# 21_볼린저밴드_02 : 볼린저밴드 지표만들기

book = df[['Close']].copy()

book['trade'] = ''

book

|

for i in df.index:

if df.loc[i, 'Close'] > df.loc[i, 'up_band']:

book.loc[i, 'trade'] = ''

elif df.loc[i, 'low_band'] > df.loc[i, 'Close']:

book.loc[i, 'trade'] = 'buy'

elif df.loc[i, 'up_band'] >= df.loc[i, 'center'] and df.loc[i, 'low_band'] <= df.loc[i,'Close']:

if book.shift(1).loc[i, 'trade'] == 'buy':

book.loc[i, 'trade'] = 'buy'

else:

book.loc[i, 'trade'] = ''

book |

23_볼린저밴드_03 : 수익률평가

rtn = 1.0

buy = 0.0

sell = 0.0

book['rtn'] = 1

for i in book.index:

if book.loc[i, 'trade'] == 'buy' and book.shift(1).loc[i, 'trade'] == '':

buy = book.loc[i, 'Close']

print('진입일 : ', i, '매수가격 : ', buy)

elif book.loc[i, 'trade'] == '' and book.shift(1).loc[i, 'trade'] == 'buy':

sell = book.loc[i, 'Close']

rtn = (sell - buy) / buy + 1

book.loc[i, 'rtn'] = rtn

print('청산일 : ', i, '매수가격 : ', buy, ' 매도가격 : ', sell, '수익률 : ', round(rtn, 4))

if book.loc[i, 'trade'] == '':

buy = 0.0

sell = 0.0

acc_rtn = 1.0

for i in book.index:

rtn = book.loc[i, 'rtn']

acc_rtn = acc_rtn * rtn

book.loc[i, 'acc_rtn'] = acc_rtn

print('누적수익률 : ', round(acc_rtn, 4))

|

~~ 중략 ~~

|

'Python > 파이썬_자동매매' 카테고리의 다른 글

| Solactive US Big Tech Top 7 Plus Price Return Index 차트만들기_파이썬 (0) | 2025.04.12 |

|---|---|

| 샤프비율 (0) | 2025.02.02 |

| 변동성 (0) | 2025.02.02 |

| MDD (Maximum Draw Down) (0) | 2025.02.02 |

| CAGR (연평균수익률) (0) | 2025.02.02 |